39 treasury bill coupon rate

Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. What are coupons in treasury bills/bonds? - Quora Bonds that mature in a year or less (called Treasury "Bills"). They are still issued with a fixed interest rate, but they have no "coupon." Instead of selling you a $1000 bond and paying you $10 in interest, they give you a 1% return by charging $991 for a bond that will mature at $1000. Conventional Treasury bonds with 10, 20 or 30 years matu

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).*. When the bill matures, you would be paid its face value, $1,000.

Treasury bill coupon rate

Daily SGS Prices - Monetary Authority of Singapore Treasury Bills: Bonds : 6-Mth: 1-Year: 2-Year: 5-Year: 10-Year: 15-Year: 20-Year: 30-Year: Issue Code Coupon Rate Maturity Date BS22110W 29 Nov 2022 BY22101N 18 Apr 2023 ... Issue Code Coupon Rate Maturity Date BS22110W 29 Nov 2022 BY22101N 18 Apr 2023 N519100A 2.000% 01 Feb 2024 NZ07100S 3.500% 01 Mar 2027 Reserve Bank of India - NSDP Display Call Money Rate (Weighted Average) 3.22: 3.27: 3.47: 3.53: 3.63: 3.87: 91-Day Treasury Bill (Primary) Yield: 3.33: 3.87: 3.98: 3.96: 3.98: 4.03: 182-Day Treasury Bill (Primary) Yield: 3.55: 4.27: 4.43: 4.41: 4.40: 4.43: 364-Day Treasury Bill (Primary) Yield: 3.72: 4.56: 4.82: 4.81: 4.81: 4.84: 10-Year G-Sec Par Yield (FBIL) 6.22: 7.13: 7.22: 7.17: 7.15: 7.46: FBIL@Reference Rate and Forward Premia Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

Treasury bill coupon rate. Treasury Bills (T-Bills) Definition As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face... Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value... Treasury Bill Rates The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year.

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Treasury Bonds Rates - WealthTrust Securities Limited A Treasury Bond (T-Bond) is a zero default-risk, extremely liquid medium to long term debt instrument issued by the CBSL which consists of maturity period ranging from 2 to 25 years with semiannual coupon payments. Unlike a T-Bill, the holder of a T-Bond will be entitled to semi-annual periodic interest payments (coupon interest) which are paid ... Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Treasury Bills vs Bonds | Top 5 Differences (with Infographics) T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. Bonds pay interest in the form of a coupon to the investors quarterly or semi-annually. T-bills have no default risk

German Rates & Bonds - Bloomberg Find information on government bonds yields and interest rates in Germany. ... Coupon Price Yield 1 Day 1 Month 1 Year Time (EDT) GTDEM2Y:GOV . Germany Bund 2 Year Yield . 0.20: 99.72: 0.33%: 0 +25 Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up ... Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. 91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 0.90. 0.86. 0.02. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding.

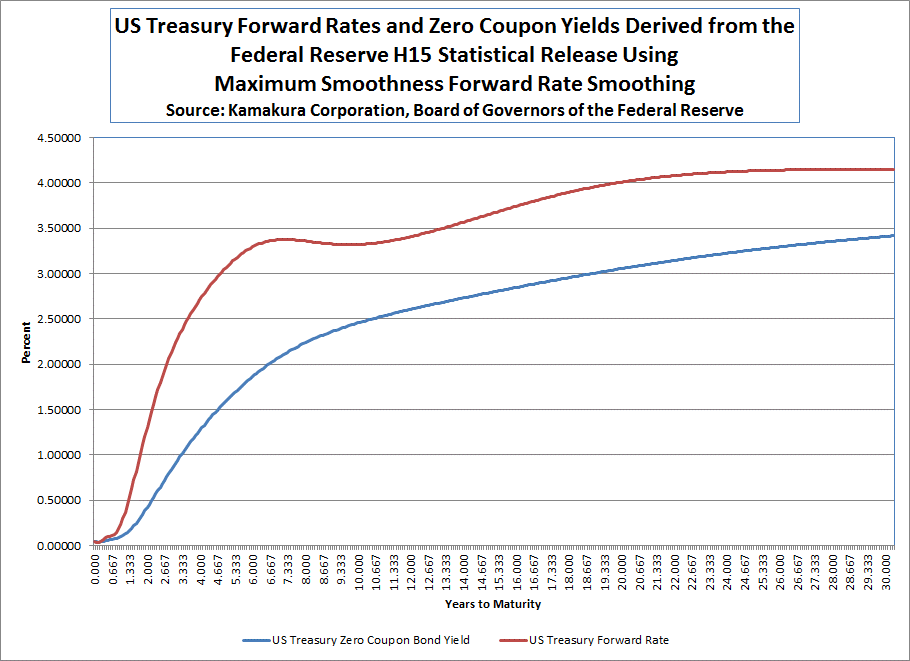

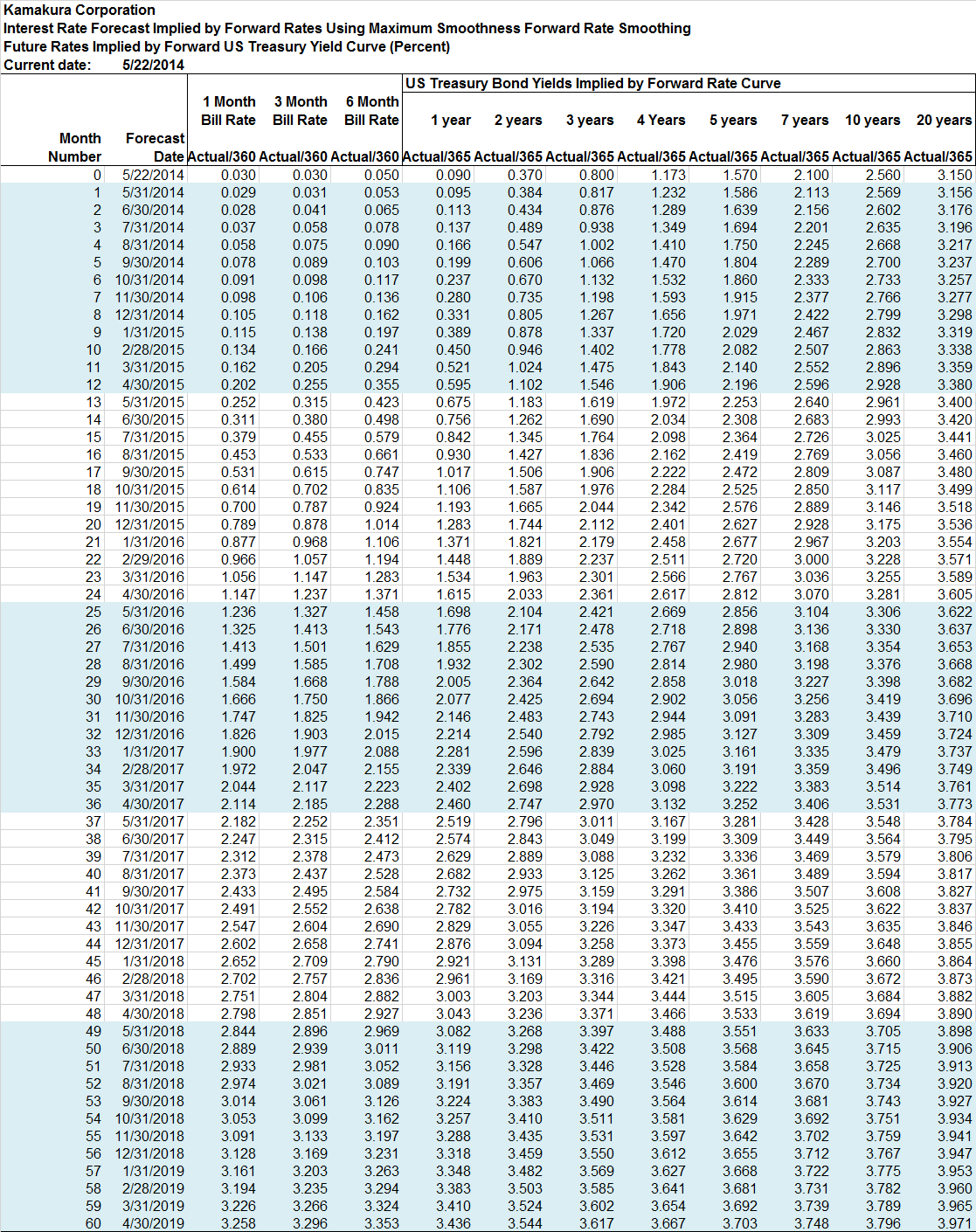

Forward 1 Month T-Bill Rates Twist With A 2021 Peak Implied At 3.38%, Down 0.07% From Last Week ...

US Treasury Bonds - Fidelity US Treasury bills: $1,000: Discount: 4-, 8-, 13-, 26-, and 52-week: Interest and principal paid at maturity: US Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, principal at maturity: US Treasury bonds: $1,000: Coupon: 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) $1,000: Coupon

T-bills: Information for Individuals T-bills: Information for Individuals Treasury bills (T-bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. Investors receive the full face value at maturity. The Government issues 6-month and 1-year T-bills. Overview AAA Credit Rating Min. $1,000 Investment Amount Buy with Cash, SRS and CPF Funds

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 2003-2007 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2008-2012 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2003-2007

Forward T-Bill Rates Twist, With Projected 10-Year Treasury Yields Up 0.17% In 2024 From Last ...

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

US Treasury Bonds Rates - Yahoo Finance US Treasury Bonds Rates. Symbol. Name Last Price Change % Change 52 Week Range Day Chart ^IRX. 13 Week Treasury Bill: 1.0430 +0.0500 +5.04% ^FVX. Treasury Yield 5 Years: 2.7570-0.1180-4.10% ^TNX ...

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

United States Rates & Bonds - Bloomberg 1.01%. +22. +102. 5/20/2022. GB6:GOV. 6 Month. 0.00. 1.43. 1.46%.

Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

Reserve Bank of India - NSDP Display Call Money Rate (Weighted Average) 3.22: 3.27: 3.47: 3.53: 3.63: 3.87: 91-Day Treasury Bill (Primary) Yield: 3.33: 3.87: 3.98: 3.96: 3.98: 4.03: 182-Day Treasury Bill (Primary) Yield: 3.55: 4.27: 4.43: 4.41: 4.40: 4.43: 364-Day Treasury Bill (Primary) Yield: 3.72: 4.56: 4.82: 4.81: 4.81: 4.84: 10-Year G-Sec Par Yield (FBIL) 6.22: 7.13: 7.22: 7.17: 7.15: 7.46: FBIL@Reference Rate and Forward Premia

Daily SGS Prices - Monetary Authority of Singapore Treasury Bills: Bonds : 6-Mth: 1-Year: 2-Year: 5-Year: 10-Year: 15-Year: 20-Year: 30-Year: Issue Code Coupon Rate Maturity Date BS22110W 29 Nov 2022 BY22101N 18 Apr 2023 ... Issue Code Coupon Rate Maturity Date BS22110W 29 Nov 2022 BY22101N 18 Apr 2023 N519100A 2.000% 01 Feb 2024 NZ07100S 3.500% 01 Mar 2027

Post a Comment for "39 treasury bill coupon rate"