40 calculate price zero coupon bond

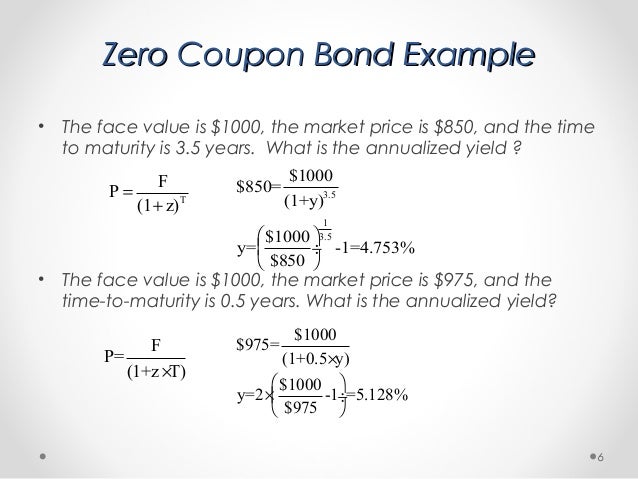

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

How to Calculate the Yield of a Zero Coupon Bond Using ... That's gonna allow us to calculate just that so let's jump into an example and I'll show you how it works. So let's say that you didn't know the yield on a five-year zero-coupon bond but you did know the forward rates here I've got the forward rates for the next five years so you've got these different forward rates here and you can essentially just plug them into this formula above and we can ...

Calculate price zero coupon bond

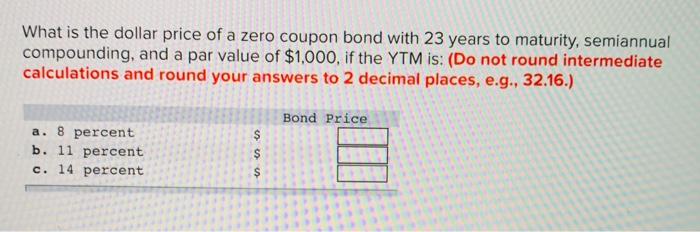

Solved Calculate the price of a zero-coupon bond that ... Calculate the price of a zero-coupon bond that matures in 13 years if the market interest rate is 5.85 percent. Assume semiannual compounding. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Calculate the price of a zero-coupon bond that matures in 13 years if the market interest rate is 5.85 percent. Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Chapter 7 - Finance 301 Flashcards - Quizlet Calculate the price of a zero-coupon bond that matures in 17 years if the market interest rate is 3.7 percent. Assume semiannual compounding. Par Value / (1+r)^n 1,000 / ((1+.0185)^34) = $536.20. What's the taxable equivalent yield on a municipal bond with a yield to maturity of 4.3 percent for an investor in the 33 percent marginal tax bracket?

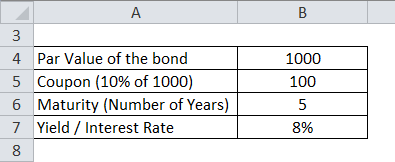

Calculate price zero coupon bond. Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Formula for Zero Coupon Bond Price : A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m(1 + r)n Where, P = Zero-Coupon Bond Price M = Face value at maturity or face value of bond r = annual yield or rate Solved Zero Coupon Bond Price Calculate the price of a ... Zero Coupon Bond Price Calculate the price of a zero coupon bond that matures in 9 years if the market interest rate is 8 percent. Assume semi-annual interest payments and $1,000 par value. (Round your answer to 2 decimal places.) Multiple Choice $920.00 $500.25 $493.63 $1,000.00 Expert Answer 100% (6 ratings) Price of bond=Par value/ ( … How to Calculate the Price of a Zero Coupon Bond ... To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. Coupon Bond Formula | How to Calculate the Price of Coupon ... Therefore, the price of each bond can be calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $1,041.58 Therefore, each bond will be priced at $1,041.58 and said to be traded at a premium ( bond price higher than par value) because the coupon rate is higher than the YTM.

Zero Coupon Bond Yield: Formula, Considerations, and ... Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ... Bond Price Calculator | Formula | Chart Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the following data to our current bond price ... Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value.

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Zero Coupon Bond Calculator - Calculator Academy The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown.

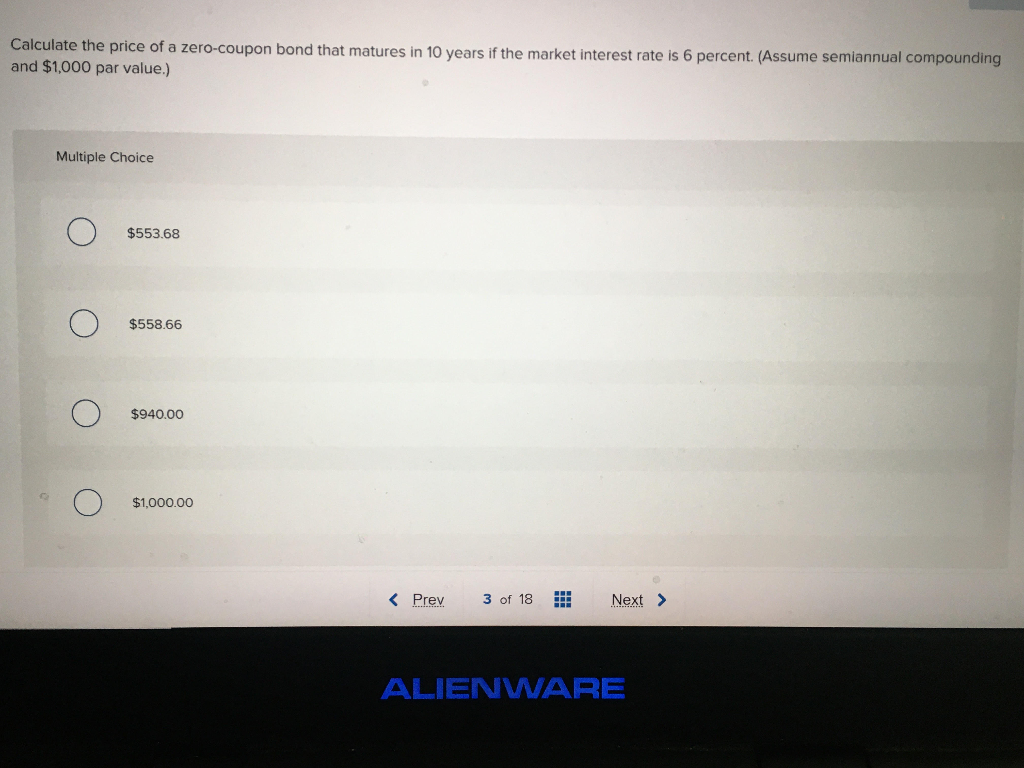

Solved Calculate the price of a zero-coupon bond that ... Calculate the price of a zero-coupon bond that matures in 10 years if the market interest rate is 6 percent. (Assume semiannual compounding and $1,000 par value.) Multiple Choice Ο $553.68 Ο $558.66 Ο $940.00 Ο $1,000.00 < Prev 3 of 18 Next > ALIENWARE

Price of a Zero coupon bond - Calculator - Finance pointers August 20, 2021. August 20, 2021. | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face ...

What Is a Zero-Coupon Bond? | The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000.

How do you calculate the price of a zero coupon bond ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2.

Zero Coupon Bond Calculator - What is the Market Price ... Zero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value).

Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01

Solved Calculate the price of a zero-coupon bond that ... Calculate the price of a zero-coupon bond that matures in five years if the market interest rate is 7.50 percent. (Assume semiannual compounding and $1,000 par value.)

Solved Zero Coupon Bond Price Calculate the price of a ... Zero Coupon Bond Price Calculate the price of a zero coupon bond that matures in 10 years if the market interest rate is 6 percent. Assume semi-annual interest payments and $1,000 par value. (Round your answer to 2 decimal places.) Multiple Choice $1,000.00 $553.68 $558.39 $940.00

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Chapter 7 - Finance 301 Flashcards - Quizlet Calculate the price of a zero-coupon bond that matures in 17 years if the market interest rate is 3.7 percent. Assume semiannual compounding. Par Value / (1+r)^n 1,000 / ((1+.0185)^34) = $536.20. What's the taxable equivalent yield on a municipal bond with a yield to maturity of 4.3 percent for an investor in the 33 percent marginal tax bracket?

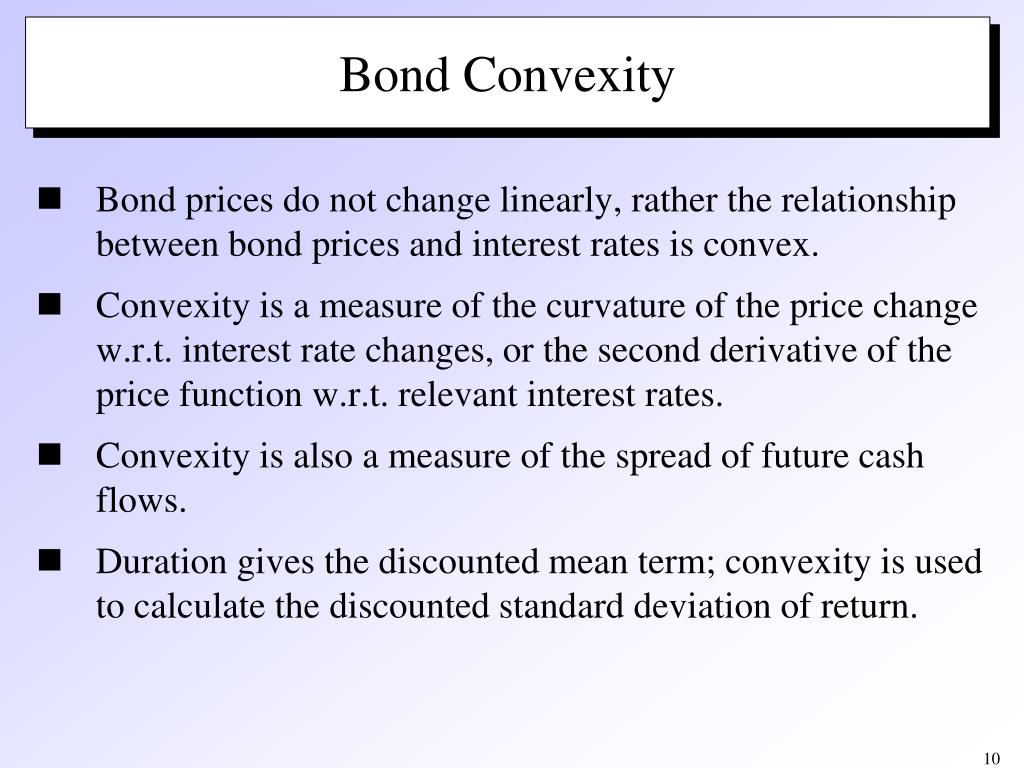

Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator

Solved Calculate the price of a zero-coupon bond that ... Calculate the price of a zero-coupon bond that matures in 13 years if the market interest rate is 5.85 percent. Assume semiannual compounding. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Calculate the price of a zero-coupon bond that matures in 13 years if the market interest rate is 5.85 percent.

Post a Comment for "40 calculate price zero coupon bond"