40 treasury bills coupon rate

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Treasury I-Bonds are Paying 7.12%! — Sapient Investments Right now, the fixed rate is zero (and has been since November 1, 2019). Because the latest 6-month increase in the CPI (3.56%) rose at an annualized rate of 7.12%, that is the current yield for I-bonds. If the CPI cools, the yield may decline, but can never become negative. Consequently, the accrued value of an I-bond can never decline.

Investing in Treasury Bills: The Safest Investment in 2022 Secondly, as per the U.S. Treasury website, the highest interest rate on a T-bill is around 0.10%. Either way you slice it, you are not going to be living in retirement off of Treasury bills. However, for the longer-term T-notes and T-bonds, interest is paid every six months.

Treasury bills coupon rate

Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding. A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. Treasury Rates, Interest Rates, Yields - Barchart.com This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least ...

Treasury bills coupon rate. How Are Treasury Bill Interest Rates Determined? For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... US Treasury Bill Calculator [ T-Bill Calculator ] US T-Bills (Treasury Bills) are very safe short term bonds supplied by the US government, with a maturity period of less than one year. ... The annual percentage profit rate based the period of the treasury bill investment; The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 ... What Is a Treasury Note? How Treasury Notes Work for Beginners Treasury bills have maturities of two, three, five, seven, and ten years. Treasury bills, notes, and bonds, are all forms of debt commitments that the United States Treasury sells. ... Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

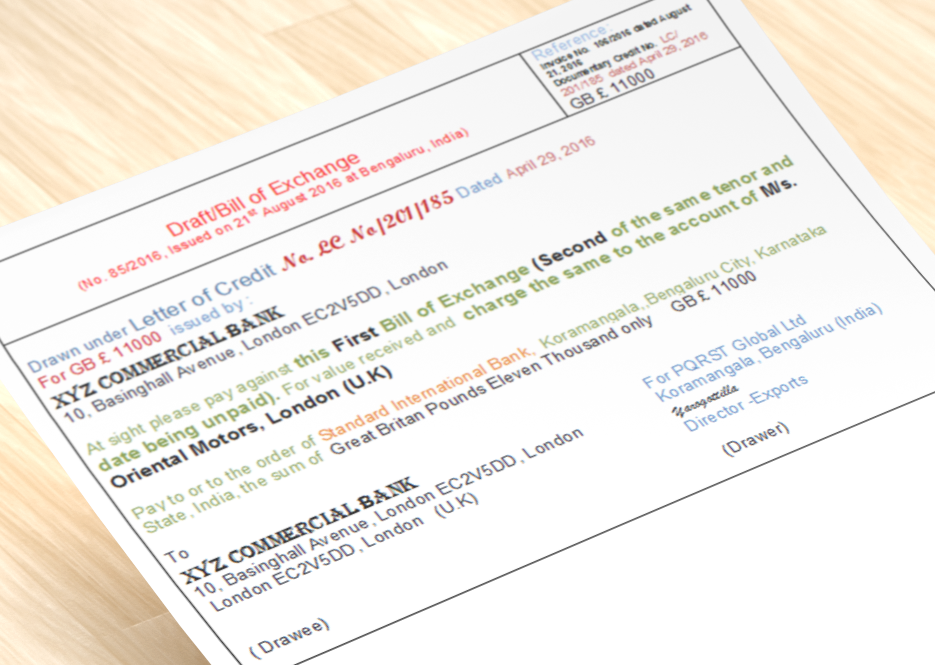

What are coupons in treasury bills/bonds? - Quora Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually. Since these securities almost never sell at par, the coupon rate almost never corresponds to the return the investor will receive by Continue Reading Louis Cohen , took Fischer Black's finance class Individual - Treasury Bills In Depth Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ... Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

T-bills: Information for Individuals Treasury bills (T-bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. Investors receive the full face value at maturity. The Government issues 6-month and 1-year T-bills. ... Interest rate No coupon. Issued at a discount to the face value. Interest payments

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury rates. Home / Treasury and the Markets / Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 16 May 2022: 1798: 364 DAY BILL: 17.8493: 21.7275: 16 May 2022: 1798: 91 DAY BILL ...

Daily Treasury Bill Rates Data - CKAN The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill's yield based on the purchase price, discount, and a 365- or 366-day year.

Treasury Bills (T-Bills) Definition As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face...

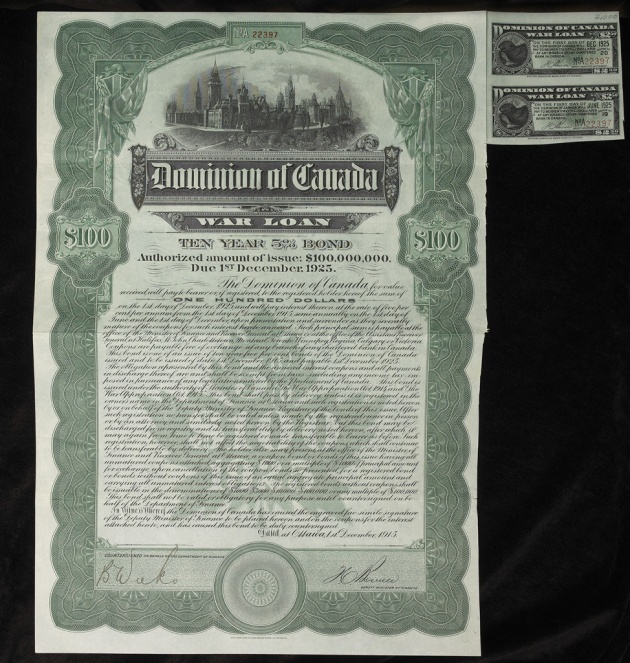

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Treasury Bills (T-Bills) - What They Are & How to Buy for Investment The Treasury auctions T-bills to investors, who purchase the security at a discount to the face value. For example, an investor may purchase a bill with a $1,000 face value and a six-month maturity at a price of $950. In six months, when the investment matures, the investor receives $1,000, producing $50 in profit.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. ... Examples of zero-coupon bonds include U.S. Treasury bills and U.S. savings bonds. Insurance companies prefer these types of bonds due to their long duration and due to the fact that they help to minimize the insurance company ...

How does the U.S. Treasury decide what coupon rate to offer on ... - Quora Answer (1 of 3): The coupon is usually set close to yield within typical rates i.e. 1/16th or 1/32 to generate a near par price. Trading too far away from par will either raise less money or reduce the appetite for investors if it is purchased way above par. The new issue or on-the-run can also ...

Treasury Bills vs Bonds | Top 5 Differences (with Infographics) T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. Bonds pay interest in the form of a coupon to the investors quarterly or semi-annually. T-bills have no default risk

Markets Wrap| Treasury bills ends week at 3.8% after bearish trading, overnight lending rate ...

Treasury Rates, Interest Rates, Yields - Barchart.com This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least ...

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

Post a Comment for "40 treasury bills coupon rate"