40 zero coupon bond yield calculation

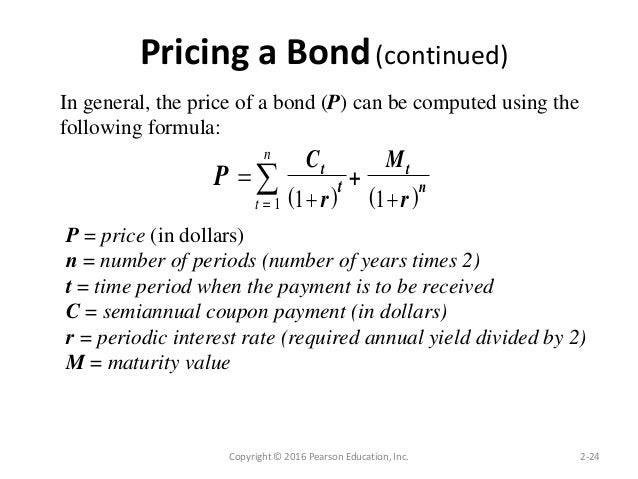

How to Calculate the Price of a Zero Coupon Bond ... Zero-coupon bonds differ from traditional bonds in that they don't make periodic interest payments. That doesn't mean zero-coupon bonds are a bad investment. To calculate how much you should pay for a zero-coupon bond, you need to know the rate of return that you're expecting to return on the bond. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to Calculate a Zero Coupon Bond Price | Double Entry ... n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

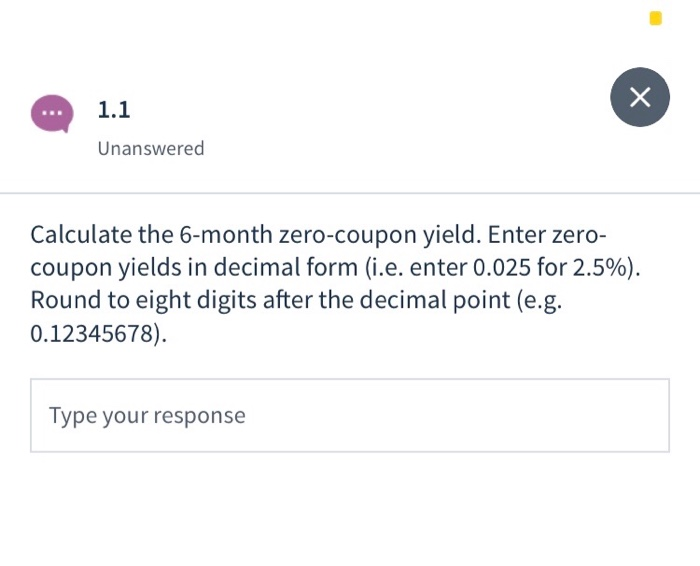

Zero coupon bond yield calculation

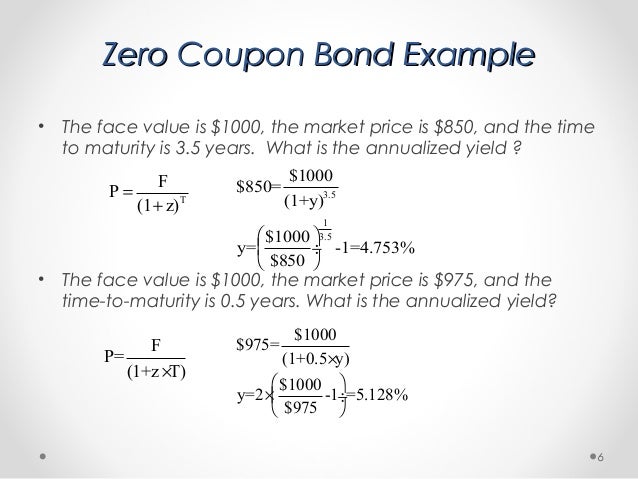

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods Zero Coupon Bond - Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Zero Coupon Bond Value Calculator - Find Formula, Example ... Example of Zero Coupon Bond Value Calculator Usage . A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5

Zero coupon bond yield calculation. Zero Coupon Bond Effective Yield Calculator | StableBread Perpetuity Yield (PY), Present Value of Perpetuity (PVP), and Perpetuity Payment (PP) Calculator Present Value (PV) and Future Value (FV) Number of Periods Calculator Present Value (PV) Calculator Present Value of Preferred Stock (PVPS) Calculator Profitability Index Calculator Dividends Dividend Discount Model (DDM) Calculator Zero Coupon Bond Calculator - What is the Market Price ... Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Zero Coupon Bond Yield Calculator - YTM of a discount bond This calculator can be used to calculate the effective annual yield or yield to maturity (YTM) of investment in such bond when the bond is held till maturity. Purchase Price of Bond Face Value / Maturity Value of Bond Bond Purchase Date (DD/MM/YYYY) Bond Maturity Date (DD/MM/YYYY) % p.a.

How To Calculate Yield To Maturity Of Zero Coupon Bond In ... The yield to maturity formula for a zero-coupon bond. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. The exact same formula is used to calculate both YTM and YTC Yield to Call. For the bond is 15 and the bond will reach maturity in 7 years. Notice that we didnt need to make any adjustments to. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is ... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

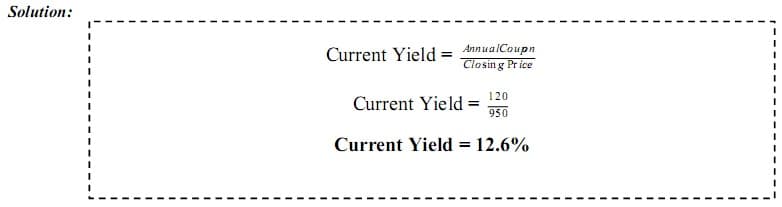

Bond Yield Formula | Step by Step Calculation & Examples Step 1: Calculation of the coupon payment Annual Payment. =$1000*5%. Annual Payment =$50. Step 2: Calculation of bond yield. =$50/$970. Bond Yield will be -. =0.052*100. Bond Yield =5.2%. Hence it is clear that if bond price decrease, bond yield increase. Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Zero Coupon Bond Calculator - MiniWebtool About Zero Coupon Bond Calculator . The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. Zero Coupon Bond Yield Calculator - Find Formula, Example ... Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1 The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1 Here, the bond will provide the investor with a yield of 7.39% What is the use of Zero Coupon Bond Yield Calculator?

Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

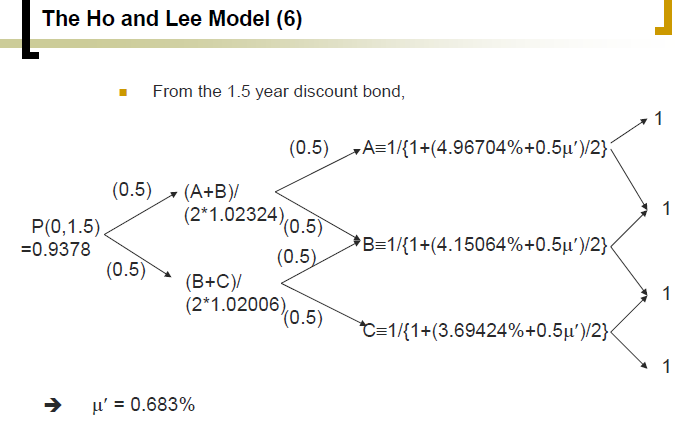

Suppose the yield to maturity on a one-year zero-coupon ... 7. Suppose the yield to maturity on a one-year zero-coupon bond is 8%. The yield to matu-rity on a two-year zero-coupon bond is 10%. Answer the following questions (use annualcompounding):(a) According to the Expectations Hypothesis, what is the expected one-year rate in themarketplace for year 2?(b) Consider a one-year investor who expects the yield to maturity on a one-year bond toequal 6% ...

How to Calculate the Yield of a Zero Coupon Bond Using ... Then now we just subtract 1 from each side so that's gonna give us 0.066 is equal to our yield to maturity on a five-year zero-coupon bond and another way of expressing that 0.066 is 6.6% that's the same thing it's just our way of expressing that decimal.

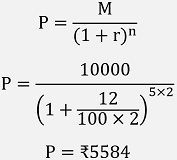

Zero-Coupon Bond Calculation - MYMATHTABLES.COM A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate . n = years until maturity ...

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Zero Coupon Bond Effective Yield Calculator | Calculate ... Zero Coupon Bond Effective Yield Solution STEP 0: Pre-Calculation Summary Formula Used Zero Coupon Bond Effective Yield = (Face Value/Present Value)^ (1/Number of Periods)-1 ZCB Yield = (F/PV)^ (1/n)-1 This formula uses 3 Variables Variables Used Face Value - Face value is the nominal value or dollar value of a security stated by the issuer.

Zero Coupon Bond Value Calculator - Find Formula, Example ... Example of Zero Coupon Bond Value Calculator Usage . A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5

Zero Coupon Bond - Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "40 zero coupon bond yield calculation"