41 pricing zero coupon bonds

Fixed Income Pricing - Fixed Income | Charles Schwab Schwab uses the same pricing schedule for sell orders, which must be placed through a broker and are subject to a $25 broker-assisted transaction fee. Large block transactions (orders of more than 250 bonds) may be eligible for special handling and/or pricing—please call for information. Coupon Bonds and Zeroes - NYU Stern Coupon Bonds and Zeroes. Concepts and Buzzwords. • Coupon bonds. • Zero-coupon bonds. • Bond replication. • No-arbitrage price relationships. • Zero rates.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

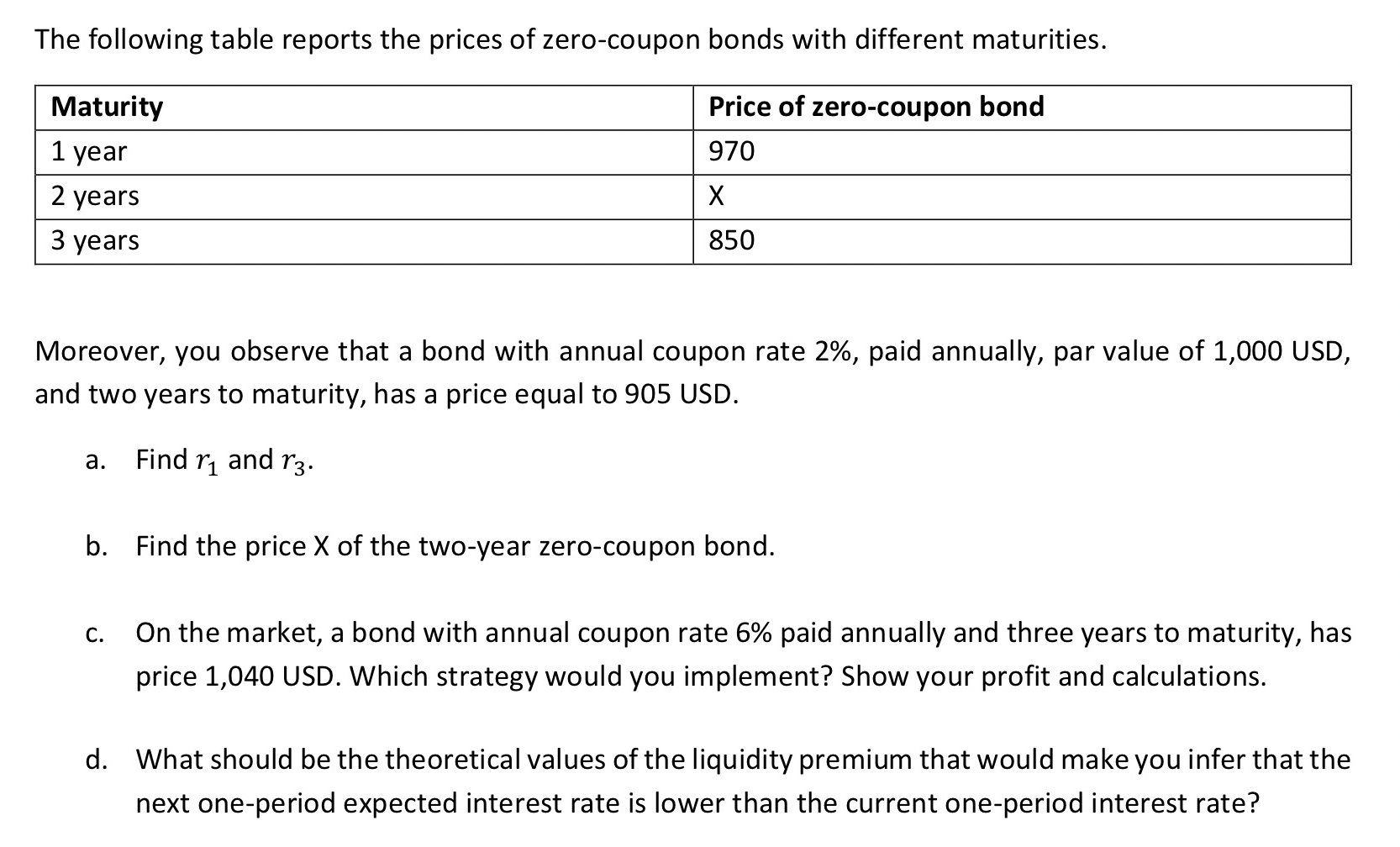

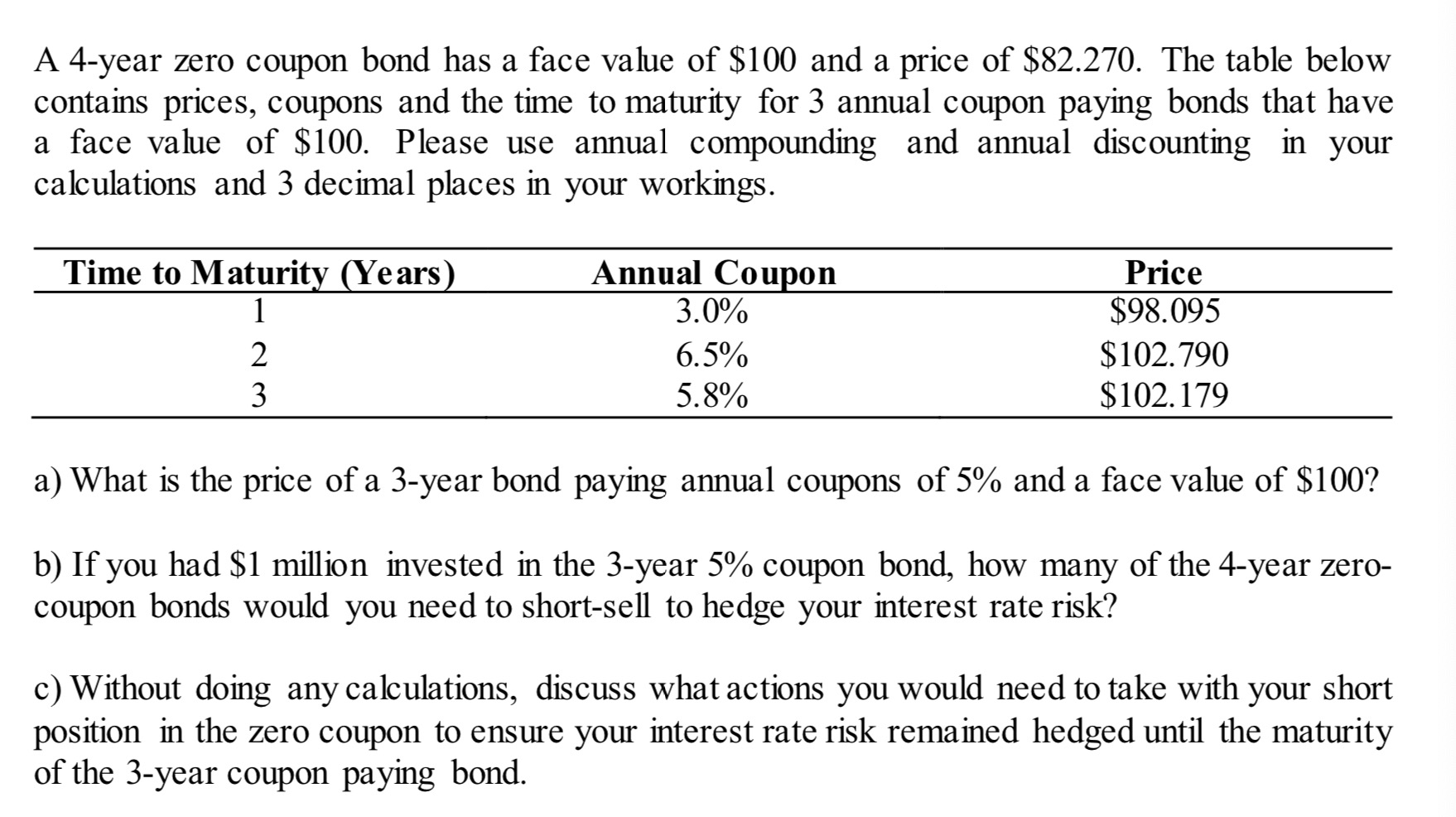

Pricing zero coupon bonds

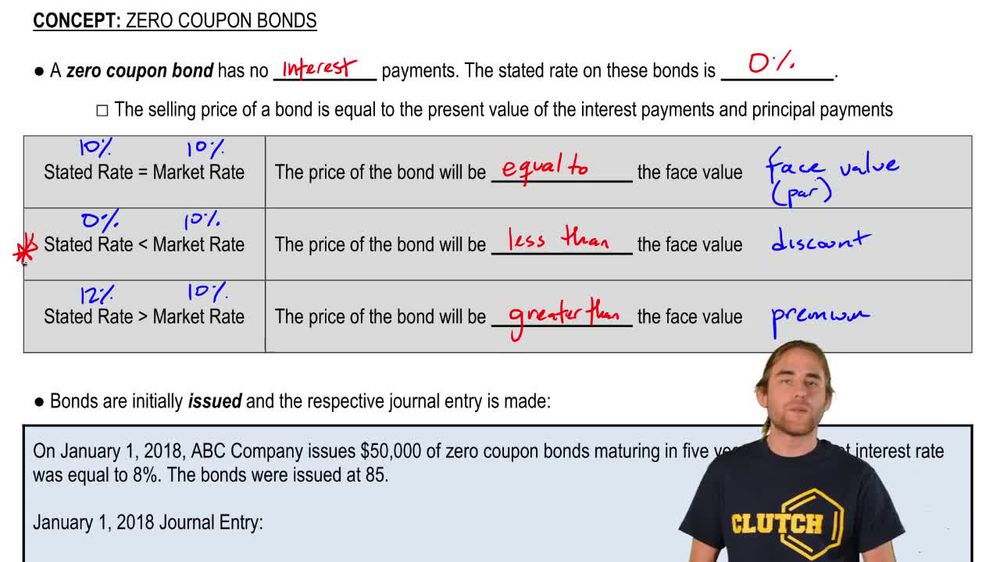

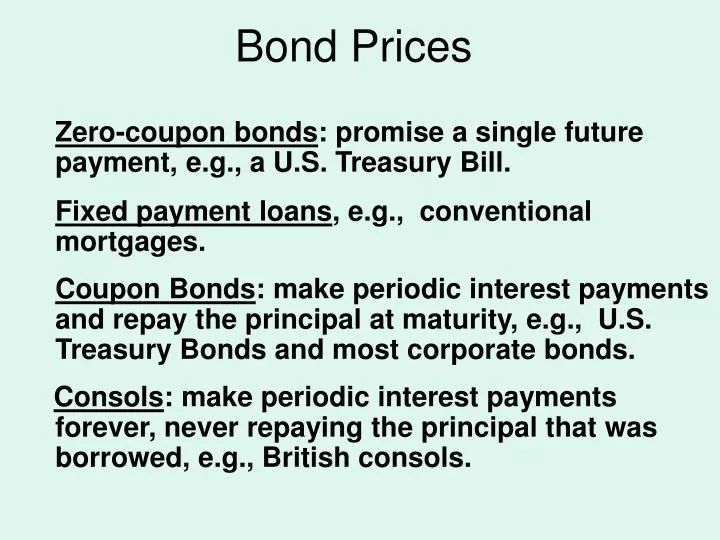

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is ... Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... Pricing Zero-Coupon Bonds · Face value is the future value (maturity value) of the bond; · r is the required rate of return or interest rate; and ...

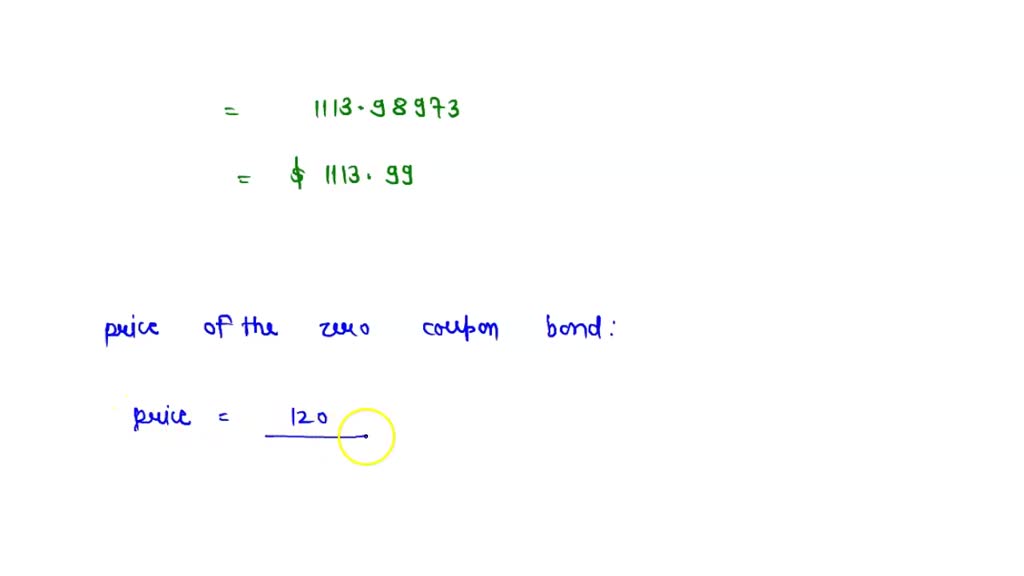

Pricing zero coupon bonds. Zero Coupon Bond Value - Financial Formulas (with Calculators) To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may ... Coupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion. Bond (finance) - Wikipedia The bondholder receives the full principal amount on the redemption date. An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... Maturity dates and interest rates dictate the price of zero coupon bonds. When interest rates are higher, the purchase price is lower. A ...

MSN MSN Zero Coupon Bond: Definition, Features & Formula - FreshBooks Nov 24, 2022 ... Zero-coupon bonds have the pricing sensitivity to the current market interest rate conditions as one disadvantage. Interest rates and bond ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ... What are Zero-Coupon Bonds? (Characteristics + Calculator) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Pricing Zero Coupon Bond - Zenodo Investors buy zero coupon bonds at a deep discount from their face value. ▫ A zero coupon bond generates gains from the difference between the purchase price ... TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 4:34p Here’s what stock-market investors are getting wrong about China and its zero-COVID policy, ... Coupon Rate 4.125%; Maturity Nov 15, 2032; Performance. 5 Day ... Related Bonds - Maturity ... Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... Pricing Zero-Coupon Bonds · Face value is the future value (maturity value) of the bond; · r is the required rate of return or interest rate; and ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ...

Post a Comment for "41 pricing zero coupon bonds"