41 difference between coupon rate and market rate

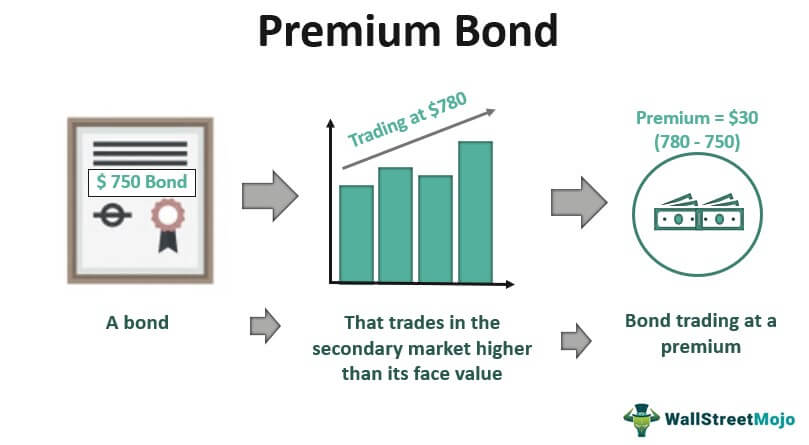

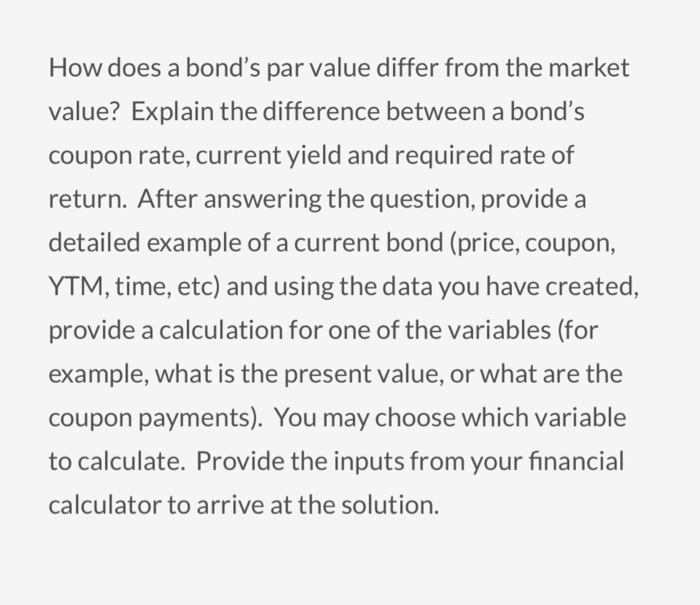

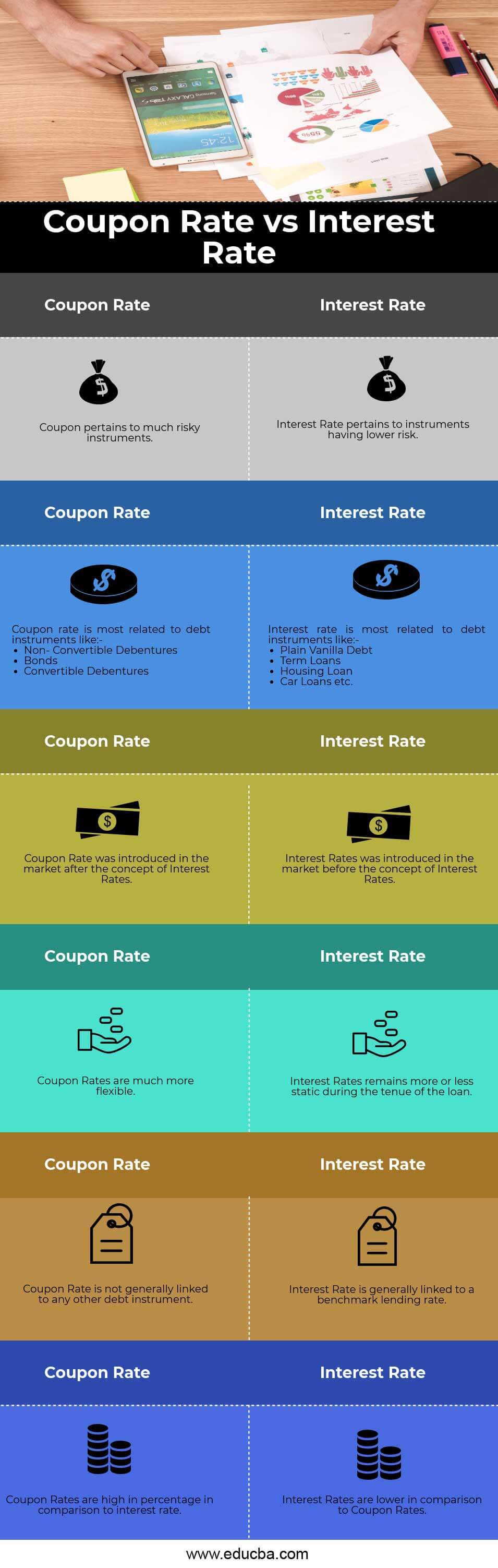

Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below ... Coupon Rate vs Interest Rate - WallStreetMojo The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. ... Coupon rates are largely affected by the ...

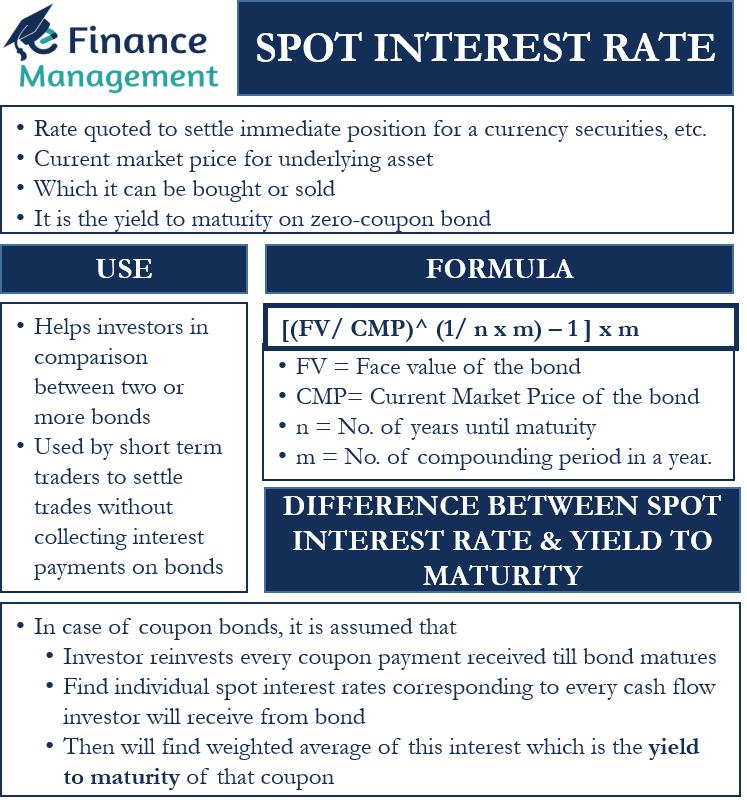

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

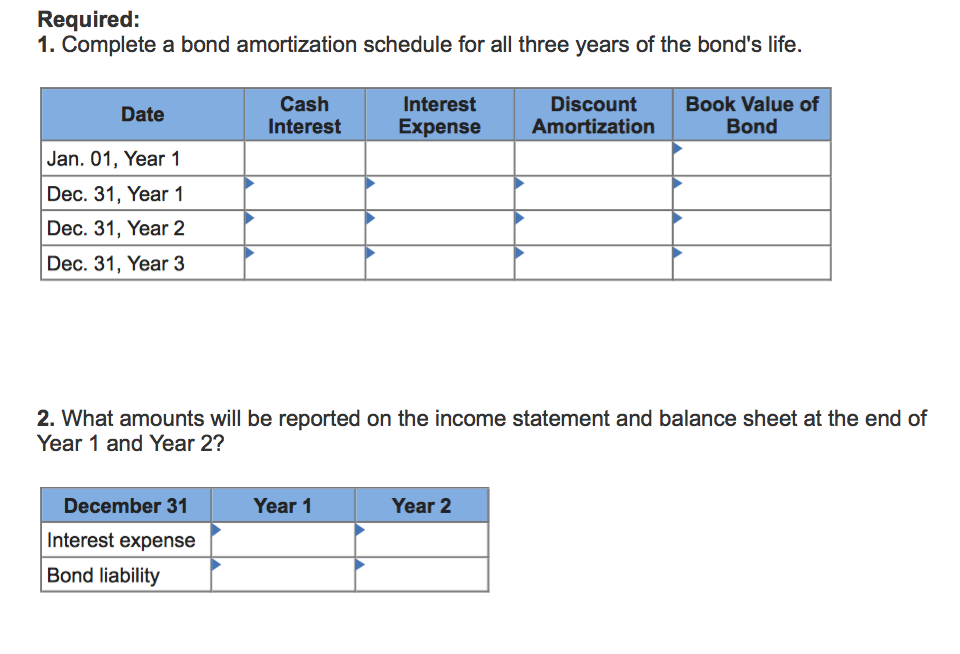

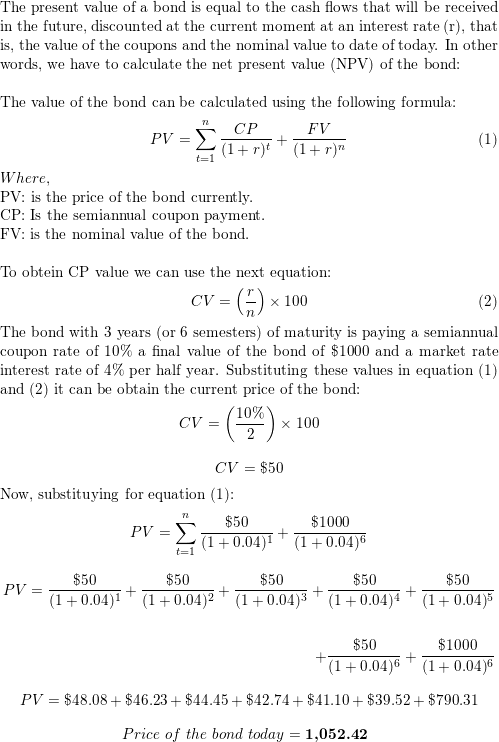

Difference between coupon rate and market rate

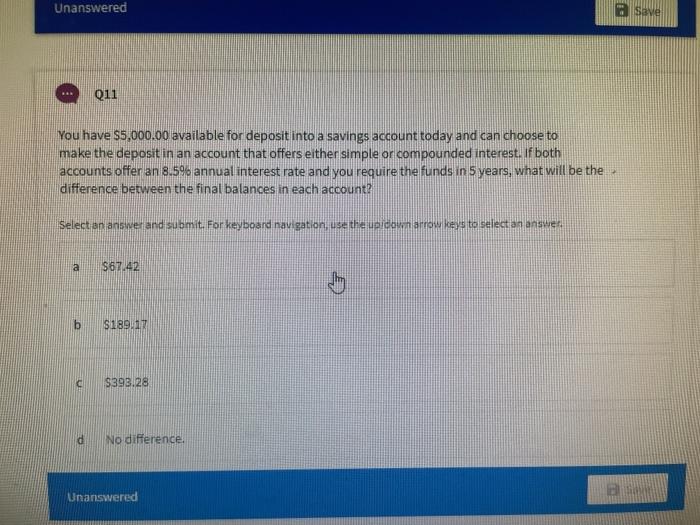

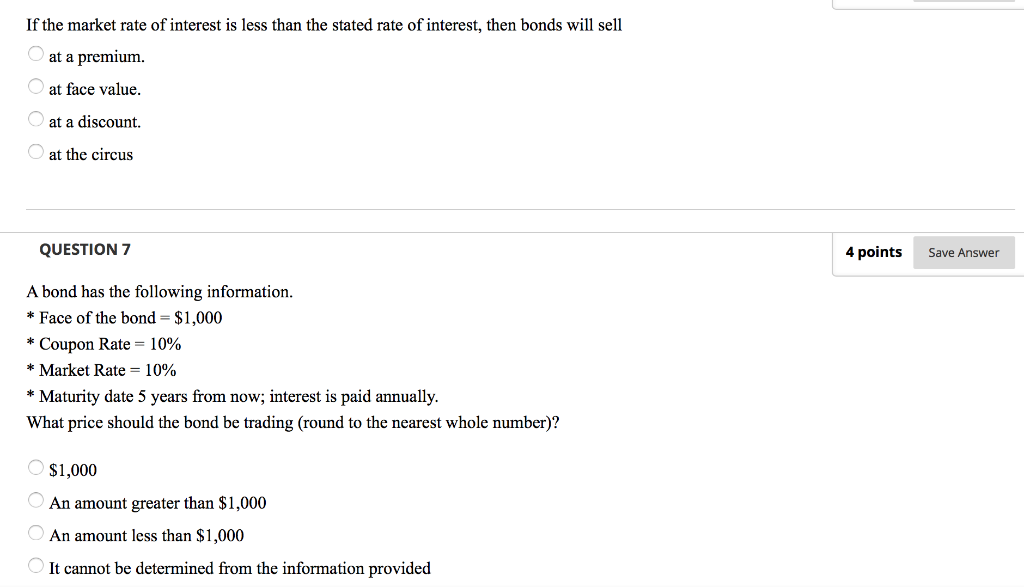

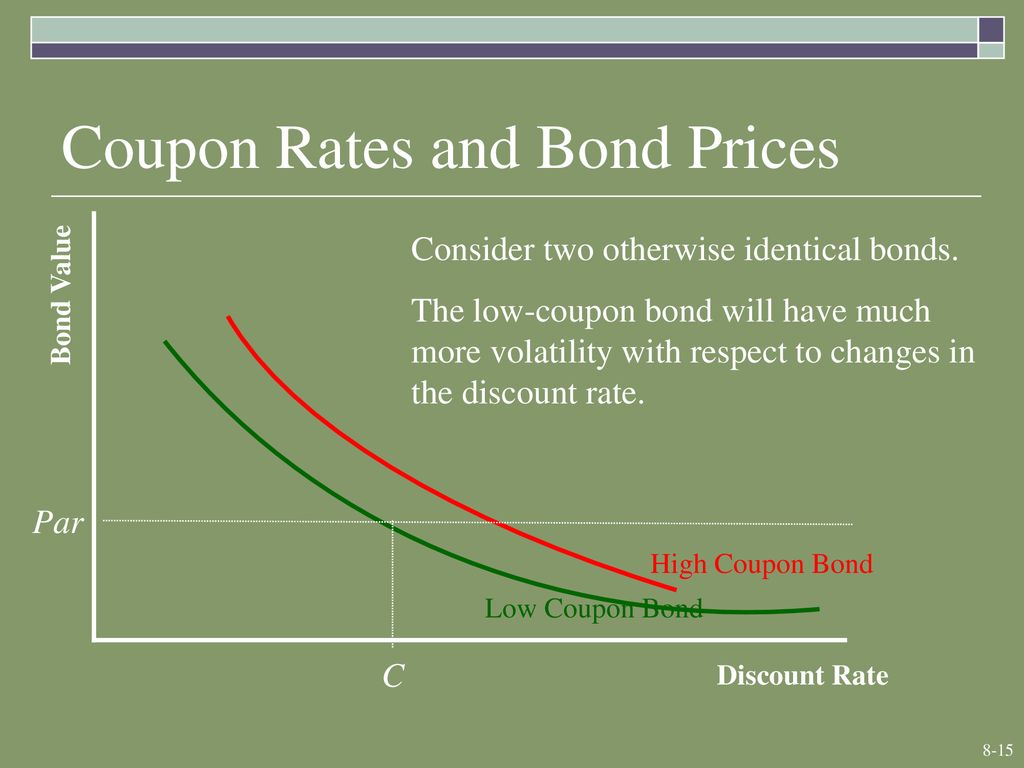

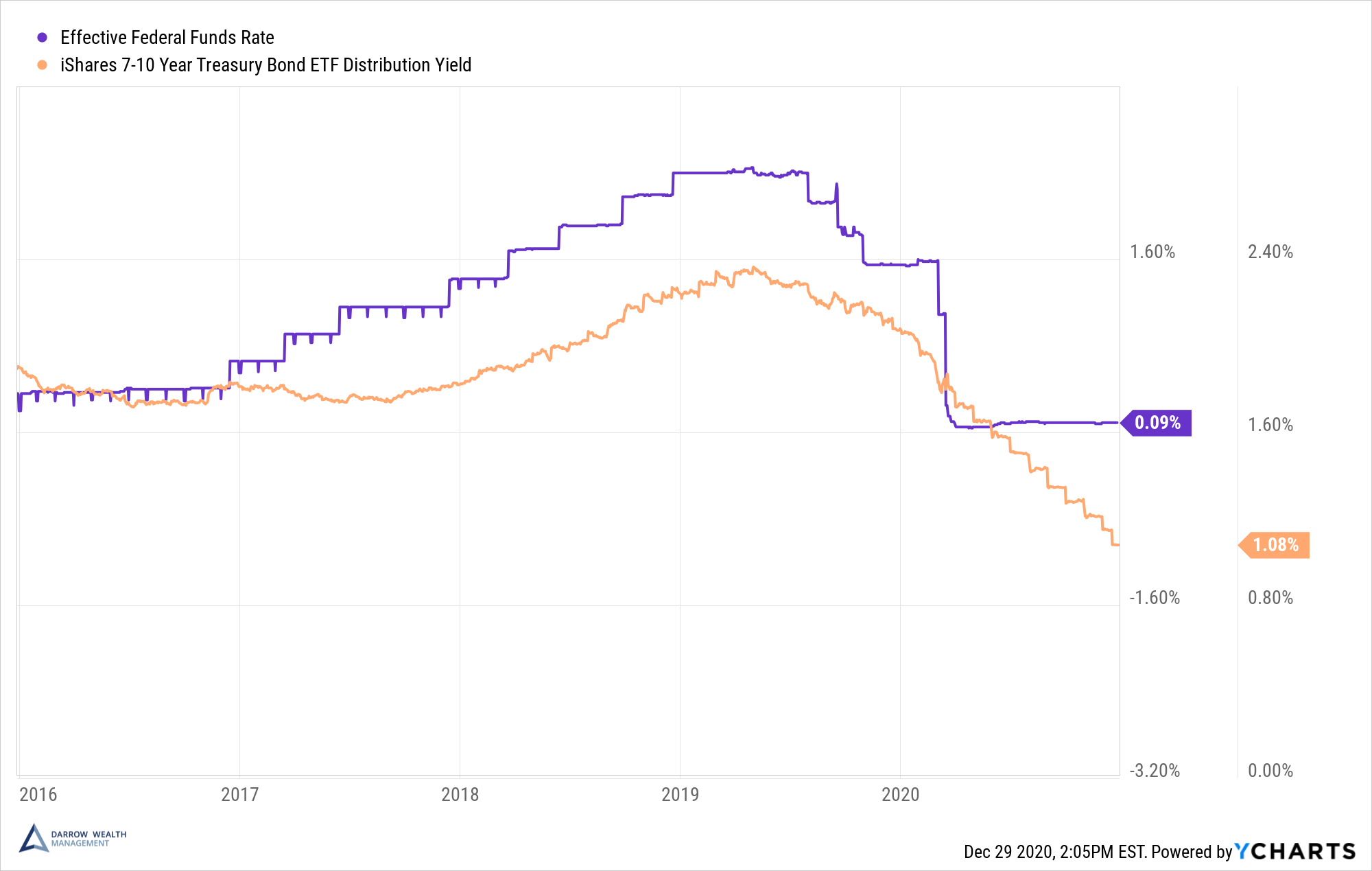

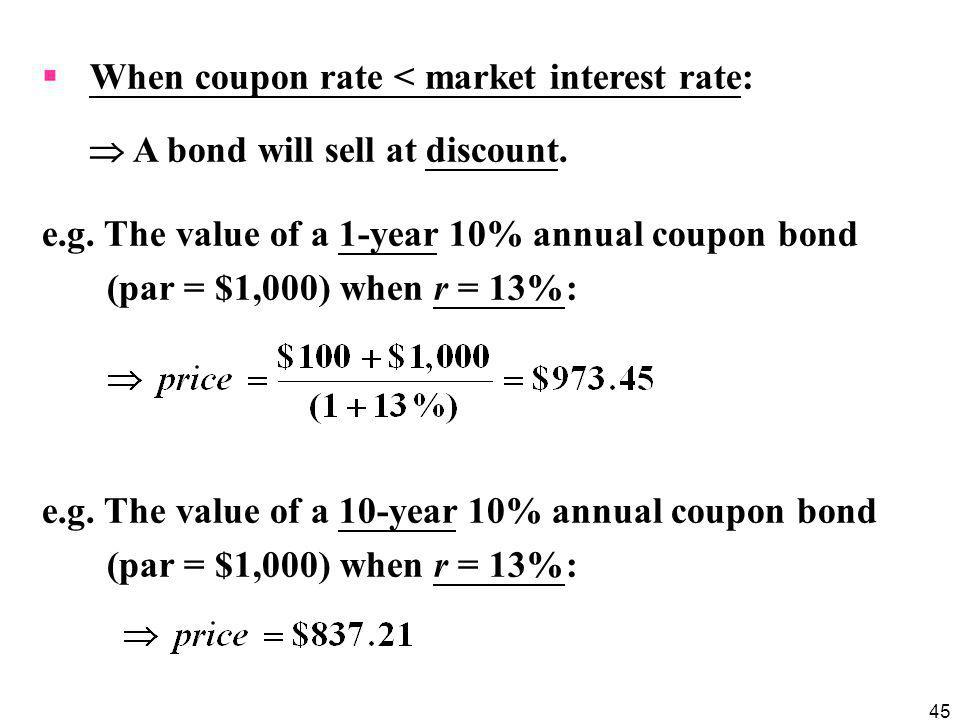

What is the difference between coupon and yield? Coupon refers to the stated interest rate payable each year, while yield refers to the actual return an investor earns from holding a bond for a year.] What is the difference between coupon rate and market - Course Hero What is the difference between coupon rate and market rate?If a bond sells at its par value or face, you will get your principle back plus the periodic ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with ...

Difference between coupon rate and market rate. Coupon Rate Definition - Investopedia What's the Difference Between Coupon Rate and YTM? ... The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It ... Bond Stated Interest Rate Vs. Market Rate - PocketSense A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change ... Coupon Rate - Definition - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond ... Difference between Coupon Rate And Yield To Maturity - Angel One Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with ... What is the difference between coupon rate and market - Course Hero What is the difference between coupon rate and market rate?If a bond sells at its par value or face, you will get your principle back plus the periodic ... What is the difference between coupon and yield? Coupon refers to the stated interest rate payable each year, while yield refers to the actual return an investor earns from holding a bond for a year.]

Post a Comment for "41 difference between coupon rate and market rate"